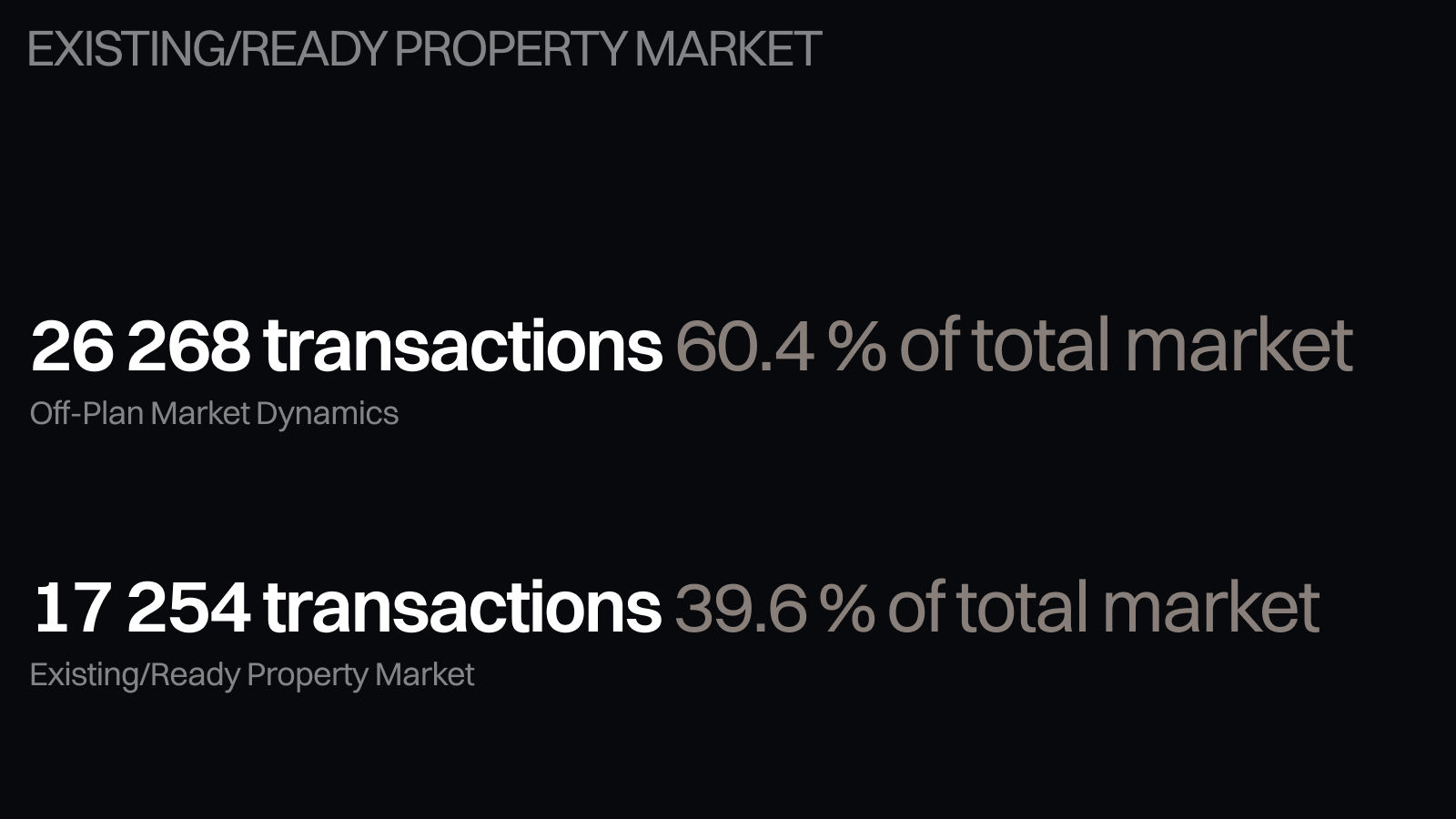

In Dubai's pivotal real estate market, a significant shift has emerged, According to reports from the Dubai Land Department and Property Finder, off-plan properties now account for 60.4% of total transactions in Q2 2024—a record-breaking milestone.

This growth isn’t just about numbers—it’s about creating long-term value. Investors aren't just buying properties; they're designing financial futures. The 60.4% off-plan transaction rate isn't a statistic—it's a narrative of calculated optimism. Young professionals, international investors, and strategic wealth builders converge in Dubai's real estate ecosystem.

Market Breakthrough: Definitive Q2 2024 Insights

"The Dubai real estate market has crossed an extraordinary threshold," states the Property Finder Market Watch report. The data speaks for itself:

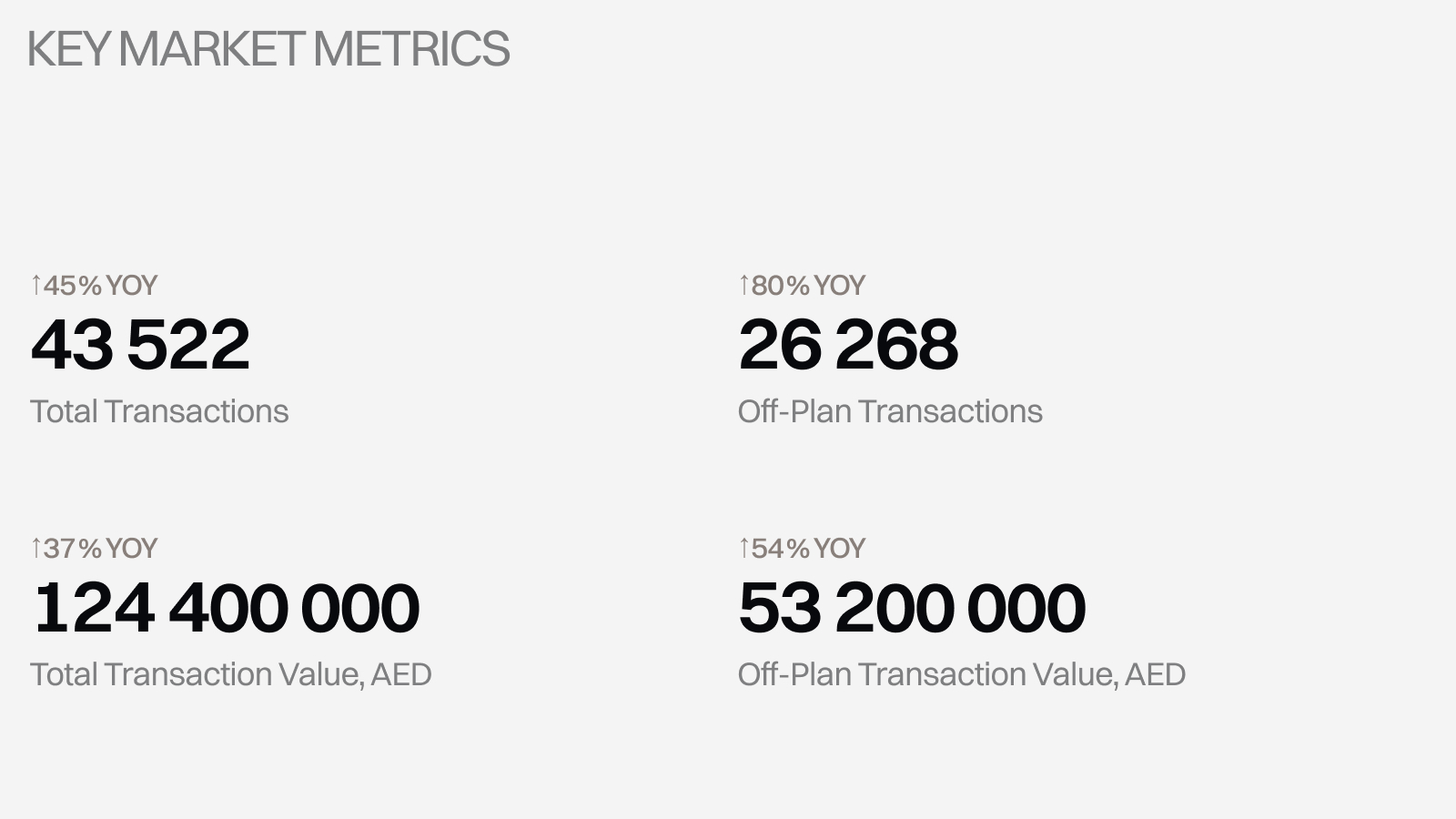

Here are some most useful numbers from the report:

In my 15 years of Dubai real estate, Q2 2024 represents a paradigm shift we've been anticipating, shares Ali, a Head of Sales at THEBROKS: I remember working with a client who purchased an off-plan property in Jumeirah Village Circle in 2019 for AED 1.2 million. Today, that same property is valued at AED 2.5 million—a testament to Dubai's incredible market potential.

Strategic Market Transformation

THEBROKS was founded on the principle of intelligent real estate, and our data-driven approach means we don't just follow market trends—we anticipate them. The Q2 2024 report validates our long-standing belief that Dubai represents a global investment frontier.

The market has achieved unprecedented heights, with Q2 2024 recording the highest volume and value of transactions ever documented. This performance surpasses previous peaks:

- Transaction volume exceeded Q1 2024 by 17%

- Transaction value marginally exceeded the Q4 2023 peak by 2%

Segment Breakdown

Off-Plan Market Dynamics

- Transactions: 26,268 (60.4% of total market)

- Comparative Milestone: Nearly matching the 2009 peak of 26,629 transactions

- Value Contribution: 57% of total transaction value

Alice from THEBROKS:

The market isn't about transactions; it's about transformative financial journeys. Our clients don't just purchase real estate; they strategically position themselves in a dynamic global market. This 60% off-plan trend? It's investors recognizing Dubai's unique value proposition.

Existing/Ready Property Market

- Transactions: 17,254 (39.6% of total market)

- Transaction Value: AED 71.19 billion

- Year-on-Year Growth: 11.6% in volume, 26.9% in value

Strategic Market Interpretation

The data reveals a nuanced market transformation:

1. Shift in Market Composition: First-time off-plan transactions exceed 60% of the total volume

2. Investor Confidence: Substantial increase in both off-plan and existing property investments

3. Market Maturity: Sophisticated investment landscape with diversified opportunities

Navigating Off-Plan Investment Hesitations in Dubai

Client Fears: Understanding Off-Plan Investment Reservations

Potential investors often have concerns about off-plan properties, driven by risks such as:

1. Development Uncertainty

- Project completion timeline risks

- Potential developer financial instability

- Historical memories of 2008-2009 market disruptions

2. Financial Commitment Challenges

- Extended payment plan complexities

- Risk of value depreciation before project completion

- Potential misalignment between initial investment and final property value

3. Execution Performance Concerns

- Variability in construction quality

- Potential discrepancies between marketed and actual specifications

- Limited immediate tangibility of investment

Compelling Counterarguments: Why Off-Plan Investments Remain Strategic

Despite prevalent hesitations, off-plan investments present robust strategic advantages:

1. Financial Optimization

- Significantly lower initial investment costs

- Flexible payment plans

- Potential for substantial capital appreciation

- Lower entry barriers compared to completed property markets

2. Market Dynamics Validation

- Q2 2024 data confirms 60.4% market transaction volume in the off-plan segment

- Institutional investor confidence

- Regulatory improvements enhancing investor protections

3. Strategic Risk Mitigation

- Dubai's enhanced regulatory frameworks

- Mandatory escrow account requirements

- Increased transparency in developer reporting

- Government-mandated completion guarantees

4. Future-Oriented Investment Model

- Access to cutting-edge architectural designs

- Potential for customization

- Alignment with emerging urban development trends

- Opportunity to secure prime locations at initial pricing

5. Economic Ecosystem Advantages

- Flexible investment structures

- Potential tax optimization

- Alignment with Dubai's strategic economic vision

- Diversification of real estate portfolio

The off-plan market isn't a speculative venture—it's a calculated investment pathway for sophisticated investors understanding Dubai's dynamic real estate ecosystem.

Future Outlook

The Property Finder Market Watch report suggests continued momentum. The market demonstrates remarkable resilience, with institutional investors increasingly recognizing Dubai's strategic real estate value.

Projected Trends:

- Sustained off-plan market performance

- Increased focus on innovative developments

- Continued international investor interest

A Transformative Investment Landscape

Dubai's real estate market in Q2, 2024 represents more than a transactional opportunity—it's a strategic financial ecosystem. The data underscores a market of unprecedented dynamism, offering calculated pathways to wealth creation.

As the market continues to evolve, investors must approach with a data-driven, strategic mindset, leveraging comprehensive insights to navigate this complex and promising landscape.

Consider this: while other markets stagnate, Dubai continues to innovate. THEBROKS team doesn't just sell properties; we curate investment ecosystems. The 45% year-on-year transaction increase isn't luck—it's the result of strategic positioning, investor confidence, and Dubai's commitment to creating world-class real estate environments.