In just two decades, Dubai's real estate market has transformed in a way reminiscent of a modern Arabian Nights story. From sandy expanses to sky-piercing towers, from boom-bust cycles to a mature, tech-driven marketplace, the transformation has been nothing short of remarkable.

Each decade has built upon the last, creating what industry experts now call the "Dubai Model" of real estate development. And if current predictions hold true, the next six years could be the most transformative yet.

THEBROKS experts with The Betterhomes' "Future Living: Dubai 2024 Edition" report on hand provides a fascinating lens through which to view this evolution.

Each decade has built upon the last, creating what industry experts now call the "Dubai Model" of real estate development. And if current predictions hold true, the next six years could be the most transformative yet.

THEBROKS experts with The Betterhomes' "Future Living: Dubai 2024 Edition" report on hand provides a fascinating lens through which to view this evolution.

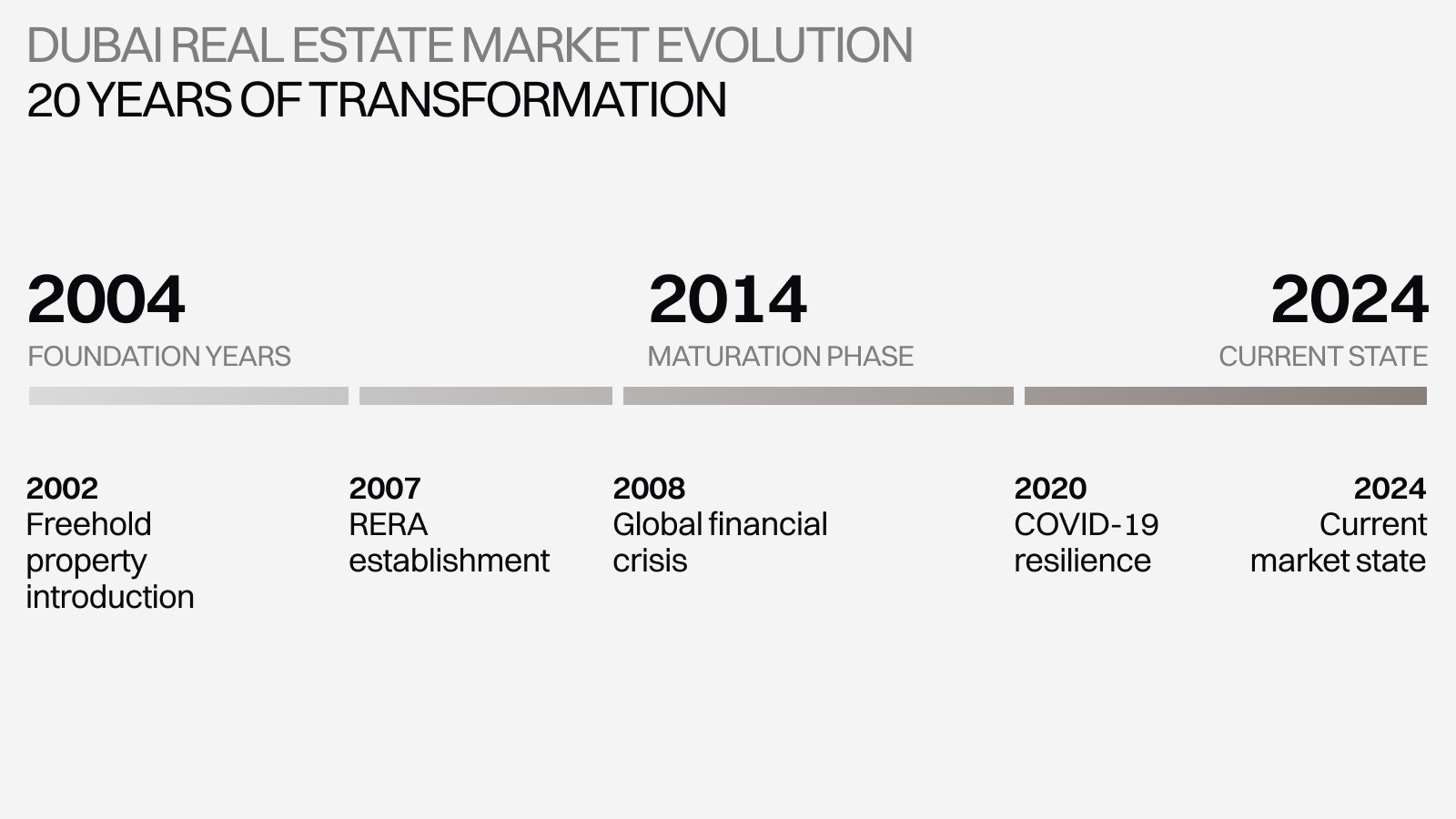

Observing the last 20 years of changes in Dubai's real estate market

2004-2014: The Foundation Years

The first major transformation of Dubai's real estate market came with the introduction of freehold property ownership for expatriates in 2002. This period saw average property prices surge by over 300% between 2004 and 2008 before the global financial crisis caused a market correction of approximately 50%.

During this decade, iconic projects like Burj Khalifa and Palm Jumeirah reshaped Dubai's skyline and global reputation. The market matured through the establishment of the Real Estate Regulatory Agency (RERA) in 2007, introducing crucial regulatory frameworks that would define future growth.

During this decade, iconic projects like Burj Khalifa and Palm Jumeirah reshaped Dubai's skyline and global reputation. The market matured through the establishment of the Real Estate Regulatory Agency (RERA) in 2007, introducing crucial regulatory frameworks that would define future growth.

2014-2024: The Maturation Phase

The second decade represented a significant evolution for Dubai, transitioning from a speculative market to an increasingly recognized and mature investment destination. According to the Betterhomes report, this period saw the emergence of master-planned communities and a shift in buyer demographics. The average property price per square foot fluctuated between AED 800 and AED 1,431, with the market showing remarkable resilience during the COVID-19 pandemic.

What's fascinating about this period — is the evolution of buyer profiles. The market moved from 70% investor-dominated transactions in 2014 to a more balanced mix of 55% end-users and 45% investors in 2024.

What's fascinating about this period — is the evolution of buyer profiles. The market moved from 70% investor-dominated transactions in 2014 to a more balanced mix of 55% end-users and 45% investors in 2024.

2024 alone: another price rise

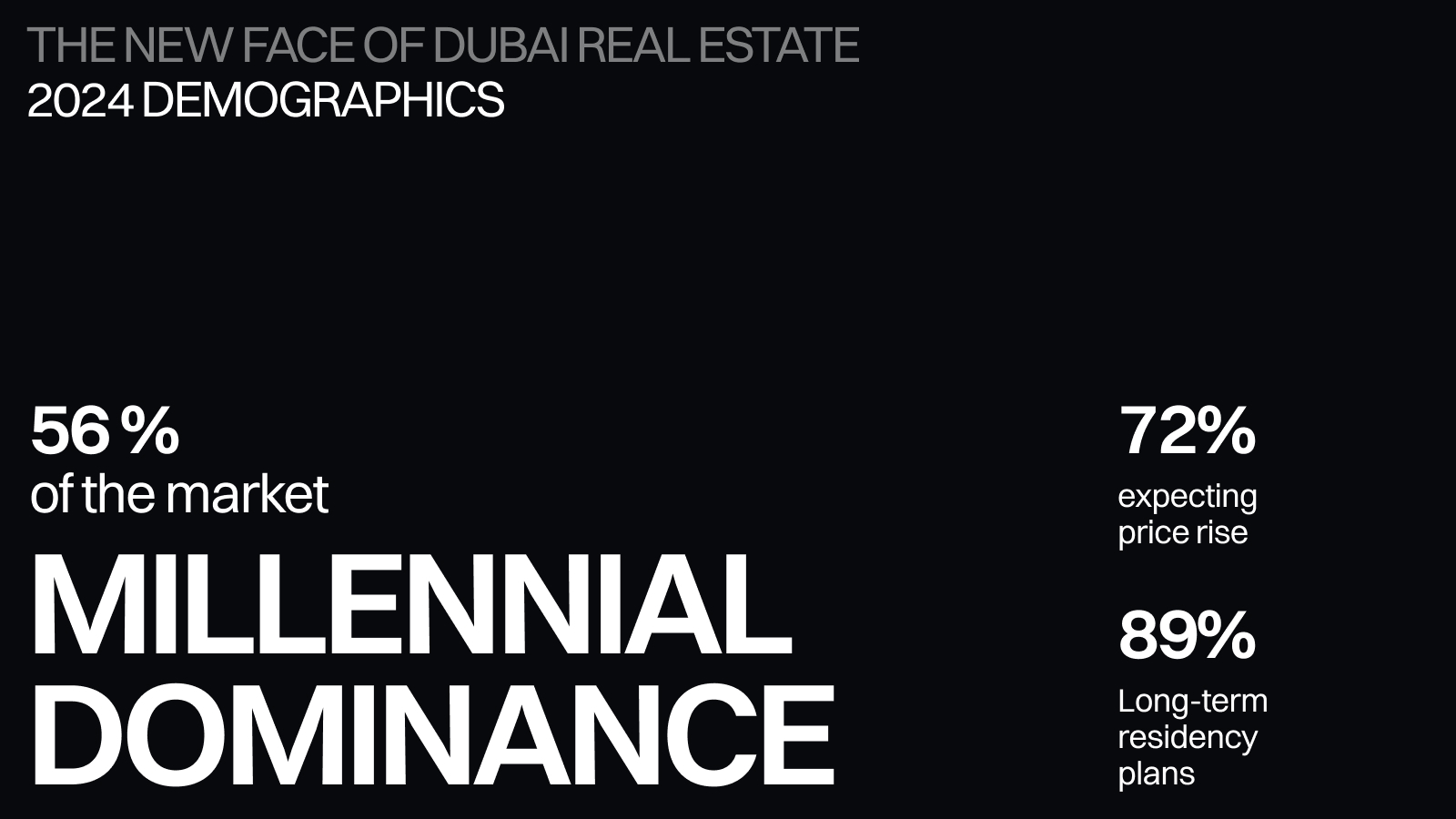

Dubai's real estate market is undergoing a significant transformation. According to Betterhomes' comprehensive "Future Living: Dubai 2024 Edition" report, a staggering 72% of residents expect property prices to rise over the next 12 months, signaling a fundamental shift in the emirate's property paradigm.

We're witnessing not just another market cycle – it's a complete reimagining of Dubai's real estate DNA. The Betterhomes report data shows that 89% of current residents plan to stay for at least five years. That's a seismic shift from the transient Dubai of the past.

Demographic Insight 2024: The Millennial Metamorphosis

The report reveals a crucial demographic insight: Millennials now represent 56% of the market, with an average age of 39.4 years for tenants and 45 years for property owners. This generational shift is reshaping investment patterns and property preferences.

Take our latest client, – Anna, THEBROKS CEO shares: A 35-year-old tech executive who initially came to Dubai for a two-year contract. Three years later, she's just closed on a two-bedroom apartment in Business Bay through THEBROKS. Her story represents thousands of young professionals who are putting down roots here.

{$te}

The transformation from a transient hub to a permanent home is backed by hard data. The Betterhomes report indicates that 66% of residents plan to live in Dubai for over a decade, creating what is called "the Dubai dream."

"Our September's client and his wife exemplify this trend," Roberts notes. "They started as THEBROKS rental clients in 2020, living in a one-bedroom apartment in Dubai Marina. Last month, they purchased a three-bedroom villa in Dubai Hills Estate, citing the area's 20-minute city concept as a key factor in their decision."

Government Initiatives: The Foundation of Growth

The Dubai Land Department's Real Estate Evolution Space Initiative (REES) and the AED 25 billion Foreign Direct Investment program are creating a robust framework for sustainable growth. According to the Betterhomes report, these initiatives are particularly appealing to the 47% of property owners who finance their homes through mortgages.

The Rental Renaissance

The report highlights that 55% of tenants expect their rents to increase by 5-10% during their next lease renewal, reflecting strong market fundamentals. This trend is particularly pronounced in premium areas like Business Bay, Dubai Hills Estate, and Jumeirah Village Circle.

Looking Ahead: The 20-Minute city in each community.

Dubai's Quality of Life Strategy 2033 aims to transform residential communities into 20-minute cities, a concept that's already influencing property values and investment decisions. The Betterhomes data shows that residents are willing to travel an average of 23 minutes for work, aligning perfectly with this vision.

"Dubai model" in a global perspective: one of the highest ROI cities

When compared to similar high-ROI market like Miami, Dubai's approach reveals unique characteristics that set it apart.

Miami: luxury real estate boom parallels Dubai's in attracting international wealth, but Dubai's year-round climate and tax benefits provide more stable growth patterns. Meanwhile, Shanghai's rapid vertical development mirrors Dubai's architectural ambitions, yet Dubai maintains a more globally diverse investor base with fewer restrictions on foreign ownership.

Singapore's: transformed from trading post to global hub, operates under stricter regulatory controls. Dubai's more flexible approach to foreign investment and freehold ownership has created a more dynamic market environment, though both cities enjoy comparable ROI ranges of 8-12% annually.

The "Dubai Model" distinguishes itself through several unique features:

- Implementation of blockchain technology in property transactions

- A higher percentage of millennial investors compared to other global cities

- Superior rental yields (6-10%) versus mature markets (3-5%)

- Master-planned communities integrating the 20-minute city concept

- Zero income tax environment enhancing overall ROI

While other markets show signs of maturity or cooling, Dubai's real estate sector demonstrates continued growth potential, supported by government infrastructure investment, emerging status as a tech hub, and strategic location between Asian and European markets.