As Dubai's real estate market is flourishing, understanding property insurance becomes increasingly important. THEBROKS has compiled this simple checklist to assist investors in protecting their assets.

№1 Understand the legal framework for buying a unit in Dubai

The real estate in Dubai is regulated by the Real Estate Regulatory Agency (RERA). This regulatory body oversees all property transactions and ensures compliance with local laws.

Chitra, a senior agent at THEBROKS, emphasizes :

"It's essential to read the Law No. 7 of 2006 and its subsequent amendments. It provides the foundation for all real estate transactions in Dubai. For instance, it outlines specific circumstances where a seller can terminate a sale due to delayed payments, even if a substantial portion has already been paid. Understanding these nuances can save you from potential headaches down the line."

The law covers several key points:

- Regulation of off-plan sales and developer obligations

- Establishment of the Real Estate Regulatory Agency (RERA)

- Rules for property registration and ownership transfer

- Guidelines for real estate brokers and their responsibilities

- Provisions for dispute resolution in real estate matters

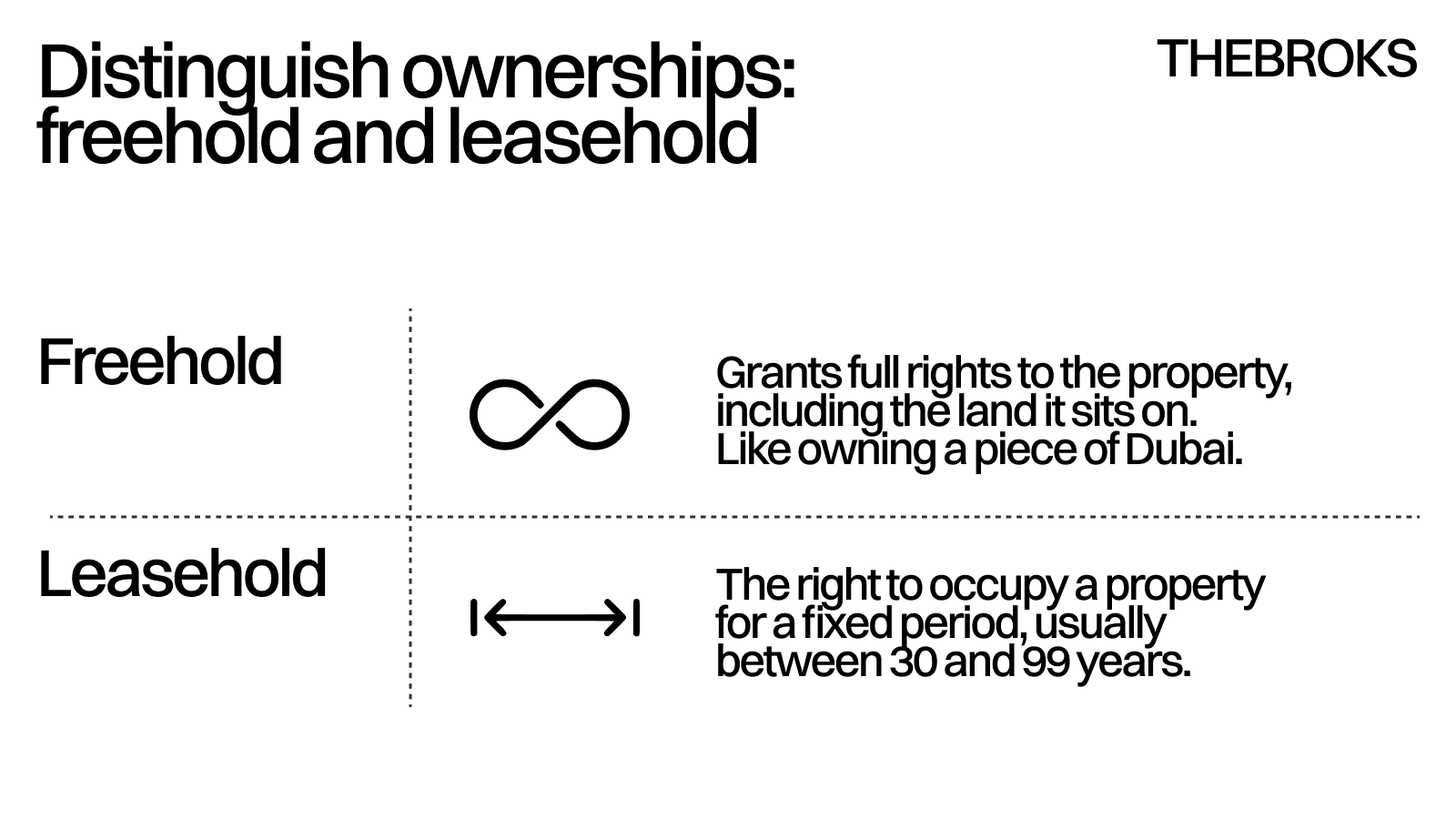

№2 Distinguish ownerships: freehold and leasehold

Wayne, THEBROKS' legal expert, clarifies:

"When considering property in Dubai, you'll encounter two main types of ownership: freehold and leasehold. Freehold ownership grants you full rights to the property, including the land it sits on. It's like owning a piece of Dubai. Leasehold, on the other hand, gives you the right to occupy a property for a fixed period, usually between 30 and 99 years. Each has its pros and cons, depending on your investment goals."

Choose freehold and leasehold keeping in mind investment goals. Freehold properties offer more flexibility and long-term investment potential. On the other hand, leasehold arrangements may be suitable for those with shorter-term objectives or for those interested in areas where freehold ownership is not available to expatriates.

The question to consider in this topic is: What is better than renting or buying a flat in Dubai? When making this decision, it is important to consider your long-term goals, your current financial situation, and the current conditions of the market.

№3 Check the steps to Buying an Apartment in Dubai

How to buy a flat in Dubai: The process involves researching, securing finances, engaging a real estate agent, selecting property, filing legal documentation, and registering officially. Here are detailed steps:

1. Research the Dubai real estate market.

2. Secure financing.

3. Engage a real estate agent.

4. Select a property and negotiate the price.

5. Sign a Memorandum of Understanding (MoU).

6. Obtain a No Objection Certificate (NOC).

7. Transfer ownership at Dubai Land Department.

Alice, an experienced THEBROKS broker, advises:

"Buying property in Dubai isn't just about finding the right place and signing on the dotted line. There's a whole process to navigate, and each step is crucial. From researching the market to transferring ownership at the Dubai Land Department, overlooking any of these steps could potentially lead to complications. That's why it's so important to work with a knowledgeable agent who can guide you through the entire journey."

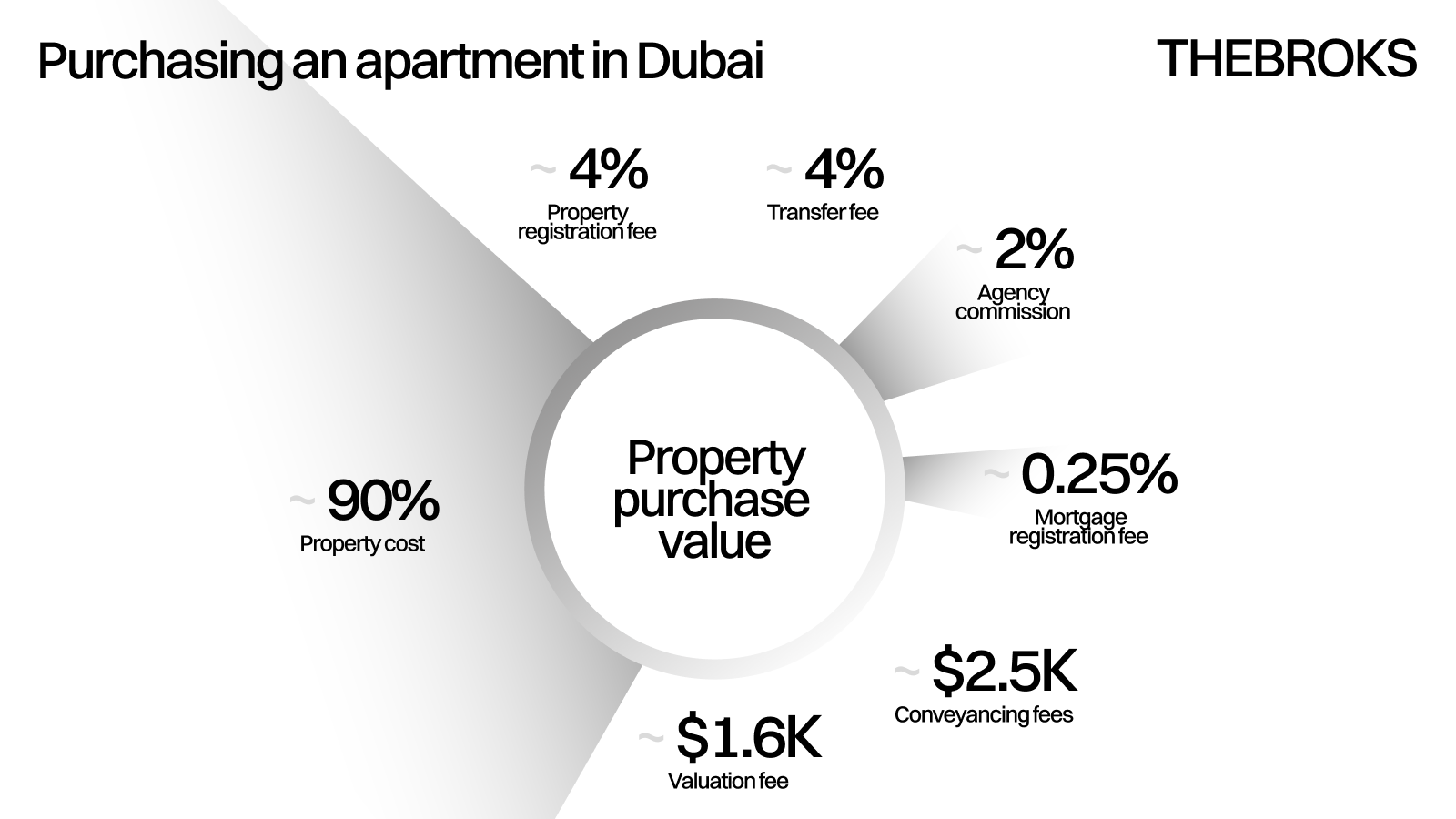

№4 Consider administrative costs when purchasing an apartment in Dubai

When planning to buy property in Dubai, it is crucial to consider extra expenses (named of the property value):

1.Transfer fee ~ 4%

2. Agency commission ~ 2%

3. Mortgage registration fee ~ 0,25%

4. Property registration fee ~ 4%

5. Valuation fee ~ $270-1600

6. Conveyancing fees ~ $1500-2500

Anna from THEBROKS advises:

"When budgeting for your Dubai property purchase, don't forget about the additional costs. These can add up quickly. As a rule of thumb, I always tell my clients to set aside an extra 6-8% of the property value for administrative costs. This includes things like transfer fees, agency commissions, and various registration fees. By planning for these expenses upfront, you'll avoid any nasty surprises down the line."

№5 Check the agent's role in buying property in Dubai

It's generally a good idea to get professional help when buying property in Dubai, especially if you're a first-time buyer or not familiar with the local market, even though it is possible to buy without an agent.

THEBROKS senior broker Alice explains:

"While it's technically possible to buy property in Dubai without an agent, I wouldn't recommend it, especially for first-time buyers or those unfamiliar with the local market. A good agent does more than just show you properties. We're here to guide you through the entire process, from negotiating the best price to ensuring all legal requirements are met. Think of us as your personal property concierge in Dubai."

№6 Understand what is the Trustee's Office in Dubai

The Trustee's Office, officially known as the Real Estate Registration Trustee, is an integral part of Dubai's property ecosystem.

Chitra from THEBROKS explains:

"The Trustee's Office, or Real Estate Registration Trustee as it's officially known, is a crucial cog in Dubai's property machine. They're not just paper-pushers – these folks oversee all property ownership transfers, meticulously verify documentation, and ensure everything's in line with local regulations. Think of them as the guardians of Dubai's property ecosystem."

№7 Find out the importance of the Title Deed in Dubai

A Title Deed is an official document that proves property ownership in Dubai, including owner details and any restrictions.

Ali, THEBROKS' head of sales, explains:

"A Title Deed in Dubai is like your property's birth certificate and passport rolled into one. It's an official document that proves you own the property, detailing everything from your name to any restrictions on the property. In many countries, this might be called a property deed or land title. It's your golden ticket in the world of Dubai real estate, so guard it carefully!"

№8 Key considerations when buying an apartment in Dubai

When you're property hunting in Dubai, keep these factors in mind:

- Location and top places nearby

- Is the developer known for quality?

- How well are the finishes?

- What perks as amenities and facilities come with the unit?

- How much is the average ROI of the property?

- If you're buying to rent out, what kind of return can you expect?

- How much are the service charges?

- What payment options are there?

For instance, we have many questions from clients, such as: Is buying a flat in Damac worth it in Dubai?

The value of investing in a Damac property depends on various factors including the location of the project, its initial price, and specific ROI for each Damac property.

Anna from THEBROKS emphasizes:

"Buying property isn't just about the price tag. There's a whole checklist of factors to consider. Location, developer reputation, quality of finishes, amenities – these all play a role in your property's value and your satisfaction as an owner. And don't forget about the financials – things like potential ROI, rental yields, and service charges can make or break an investment. It's a lot to think about, which is why having an experienced agent by your side can be invaluable."

№9 Know more about if it is easy to buy an apartment in Dubai and what are the benefits of it.

Chitra from THEBROKS provides a balanced perspective:

"Is buying property in Dubai easy? Well, with the right preparation and guidance, it can be a smooth process. But 'easy' might not be the right word – 'straightforward' is probably more accurate. As for the benefits, they're pretty compelling. You're looking at potentially high ROI, attractive rental income, tax-free returns, and let's not forget the luxurious Dubai lifestyle. It's a package deal that's hard to beat in the global property market."

But what are the benefits of buying a flat in Dubai? They are:

- A huge one of the world's top-10 ROI

- Good rental income

- Tax-free returns

- Cosmopolitan and opulent lifestyle.

№10 Find out if foreigners can buy a house in Dubai

Foreign investors in Dubai's real estate are warmly welcomed, but expatriates can only buy property in certain freehold areas like Dubai Marina, Palm Jumeirah, and Downtown Dubai.

Ali from THEBROKS clarifies:

"Dubai's property market is incredibly diverse and welcoming to foreign investors. However, it's crucial to understand that expatriates, regardless of nationality, can only buy property in designated freehold areas. These include popular spots like Dubai Marina, Palm Jumeirah, and Downtown Dubai. Always verify the property's status and location before making a purchase – it could save you a lot of headaches down the line."

Can Indians buy a flat in Dubai? Absolutely. Indian nationals are among the top foreign investors in Dubai's real estate market. They enjoy the same rights as other expatriates when it comes to property ownership in freehold areas.

What about British investors? They too can purchase property and potentially obtain residence in Dubai through their investment. The UAE has a property-linked visa program that allows foreign investors to obtain residency visas of varying durations based on the value of their property investment.

Australian buyers are also welcome in Dubai's property market.

Like other nationalities, they can freely invest in freehold properties and may be eligible for residency visas depending on their investment.

In fact, nationals from virtually any country can buy property in Dubai, provided they meet certain requirements:

- The buyer must be at least 21 years old.

- The property must be located in a designated freehold area.

- Buyers need to have a valid passport.

- Sufficient funds for the purchase must be available.

- Compliance with UAE laws and regulations is mandatory.

It's worth noting that while property ownership is open to all nationalities, the process and requirements for obtaining residency through property investment may vary. It's always best to consult with a local real estate expert or legal advisor for the most up-to-date information tailored to your specific situation.

In conclusion, buying property in Dubai offers significant opportunities but requires careful consideration and expert guidance. By following this guide and seeking professional advice, you can navigate the Dubai real estate market with confidence.