The UAE's Real Estate Mosaic: Primary Properties vs Secondary Properties

When delving into the UAE real estate market, many investors hold a common misconception: secondary market property equates solely to older apartments. In the UAE, 50% of the secondary market consists of resale of off-plan properties, blurring the lines between primary and secondary markets. Understanding prime and secondary property definition is crucial for investors in this dynamic real estate landscape.

What is primary real estate in the UAE?

Primary real estate in the UAE includes properties that developers sell directly, which are newly available on the market and ready to move in or have been recently finished. These properties have not yet been used or possessed by anyone other than the developer, setting them apart in the definition of prime and secondary properties.

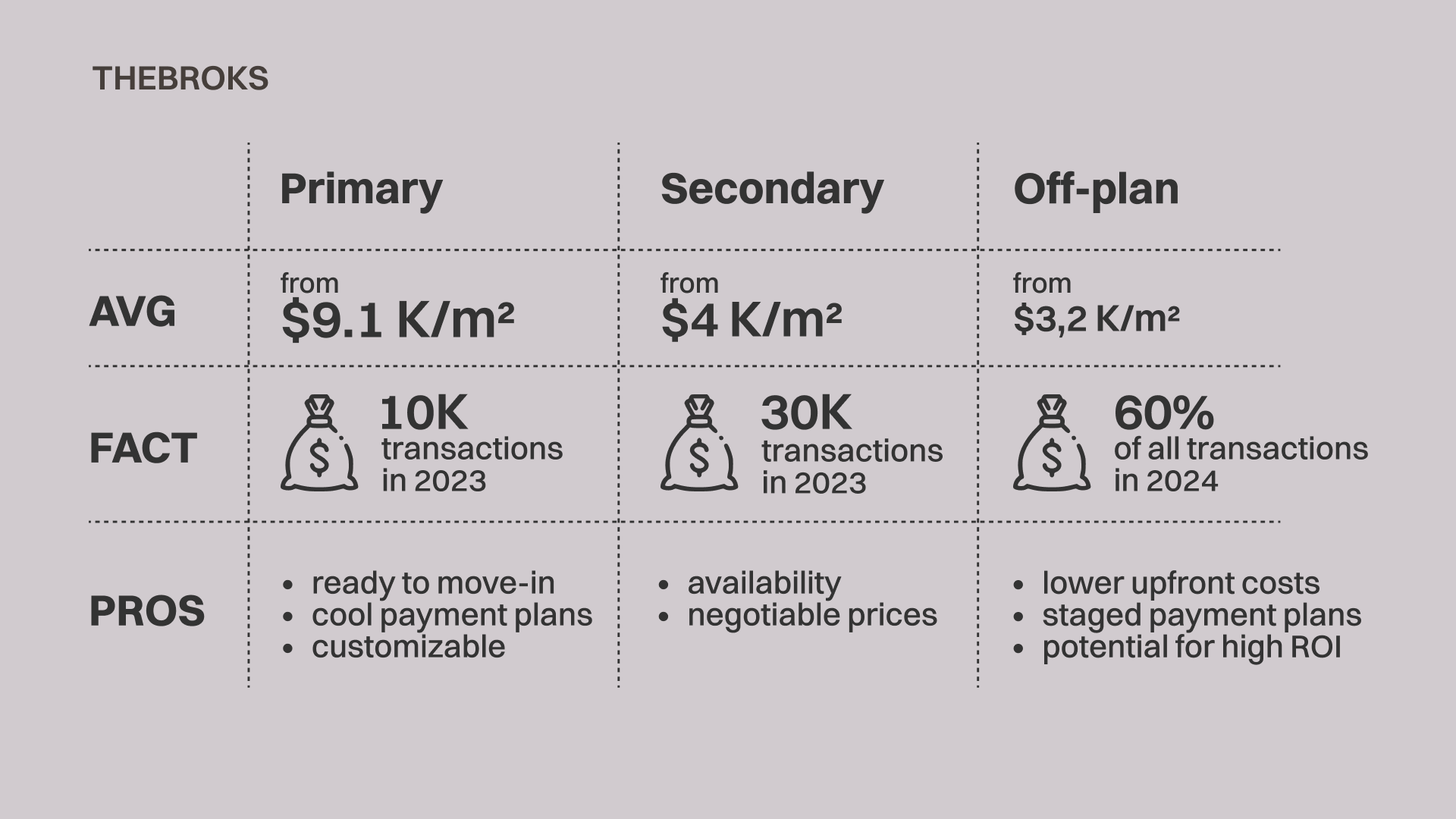

Average prices

In prime areas of Dubai: such as Downtown or Palm Jumeirah — $9,100-$11,800 per square meter.

In emerging areas: like Dubai South, prices may hover around $3,700-$5,050 per square meter.

Transaction facts

In 2023, the Dubai Land Department reported over 10,000 transactions in the primary segment alone, indicating strong investor confidence. This trend is mirrored in Abu Dhabi and other emirates, albeit on a smaller scale.

The benefits of investing in primary real estate

- ready to move-in

- modern designs

- latest amenities

- attractive payment plans offered by developers.

- buyers can sometimes customize finishes and layouts.

However, disadvantages include higher prices, risk of construction delays, and potential oversupply in certain areas.

What is off-plan real estate in the UAE?

Off-plan real estate is often purchased before completion, when the project is still in the planning, launching, or early construction stages. This subcategory of primary real estate has gained immense popularity in the UAE, with developers like DAMAC Properties, Emaar leading the charge.

The journey from DAMAC properties to Dubai Boys Secondary School, for instance, showcases how off-plan developments are transforming entire neighborhoods, enhancing connectivity and infrastructure.

Average prices

Prices for off-plan properties can be more attractive than completed units, with developers offering pre-launch rates to early investors. In areas like Mohammed Bin Rashid City, off-plan apartments might start at $3,240-$4,860 per square meter, with prices expected to appreciate upon completion.

Transaction facts

The Dubai Land Department reported that off-plan sales constituted nearly 60% of all residential transactions in recent quarters, underscoring the segment's vitality. Investors are drawn by the potential for capital appreciation and the ability to secure prime locations at lower initial costs.

The benefits of investing in off-plan real estate

- lower upfront costs

- staged payment plans

- potential for significant returns if the area develops as anticipated.

However, risks involve project delays, market fluctuations affecting final valuations, and the occasional instances of developers facing financial difficulties.

What is secondary real estate in the UAE?

Secondary real estate encompasses properties resold by individual owners rather than developers. Crucially, this includes not only older, lived-in properties but also a significant portion of never-occupied, resold off-plan units. The secondary market property segment is as diverse as it is dynamic, offering everything from luxurious penthouses to affordable studios.

Average prices

Average prices in the secondary market can sometimes exceed those in the primary sector, especially for well-maintained properties in established communities. In Dubai Marina or The Springs, secondary properties might fetch $4,050-$6,750 per square meter.

Transaction facts

Transaction volumes in the secondary market have remained strong, with the DLD noting over 30,000 secondary market deals in 2023, split almost evenly between ready and off-plan resale. This robust activity prompts many to compare why secondary market properties might be preferable for certain investors.

The benefits of investing in off-plan properties

- buyers can gauge developer progress and community development more accurately.

Disadvantages might include older designs in some properties, potential renovation needs, and less flexible payment terms compared to developer offerings.

Invest: Off-plan vs. Secondary

The decision between off-plan and secondary real estate for investment in the UAE is based on personal risk tolerance, available funds, and investment timeframe.

Off-plan properties offer the allure of lower entry costs and the potential for high returns but come with inherent risks of immediate availability

- often more negotiable prices

- often the ability to inspect the actual unit before purchase.

for resold off-plan units, market shifts and project uncertainties.

Secondary properties, including resold off-plan units, provide tangibility, immediate rental possibilities, and often locations in proven high-demand areas.

For risk-averse investors seeking steady income, secondary properties in well-established areas might be preferable. They offer clearer valuations based on current market conditions and immediate rental yields. Conversely, investors comfortable with calculated risks and longer horizons might find off-plan investments more rewarding, banking on future area development and price appreciation.

A successful real estate investment depends on thorough research, understanding personal investment goals, and recognizing the potential for rewarding returns on property. THEBROKS real estate agency is here to help you get the most profitable primary, off-plan, or secondary property in the UAE.