Are you looking for ways to buy an apartment in Dubai without overspending? For years, Dubai's remarkable architectural masterpieces and outstanding properties have consistently drawn the interest of investors worldwide. However, the high entry costs of even Dubai off-plan properties may pose challenges for some potential buyers. Actually, an outside-the-box solution is shaking up basic access to this prestigious Dubai real estate market now: property tokenization launched as a pilot phase by DLD. This game-changing approach is opening the doors to this one-of-a-kind property market. It will enabe global investors with modest savings to partake in the lucrative real estate opportunities available in the Dubai property sector.

What is Property Tokenization in Dubai?

Property tokenization in Dubai represents, in other words, the transformation of real estate assets into digital tokens on blockchain platforms, creating bite-sized ownership opportunities in the emirate's premium real estate. This cutting-edge approach lets investors buy property in the UAE without meeting those quite substantial capital requirements, effectively slicing properties into smaller, more wallet-friendly digital shares.

The Dubai Land Department (DLD), in a partnership with the Dubai Virtual Assets Regulatory Authority (VARA) and Dubai Future Foundation (DFF), is launching the pioneering Real Estate Tokenisation Project in 2023. This initiative marks, for example, the first time in the Middle East that property title deeds are being tokenized, creating a regulated framework for fractional real estate investment.

The Dubai Land Department (DLD), in a partnership with the Dubai Virtual Assets Regulatory Authority (VARA) and Dubai Future Foundation (DFF), is launching the pioneering Real Estate Tokenisation Project in 2023. This initiative marks, for example, the first time in the Middle East that property title deeds are being tokenized, creating a regulated framework for fractional real estate investment.

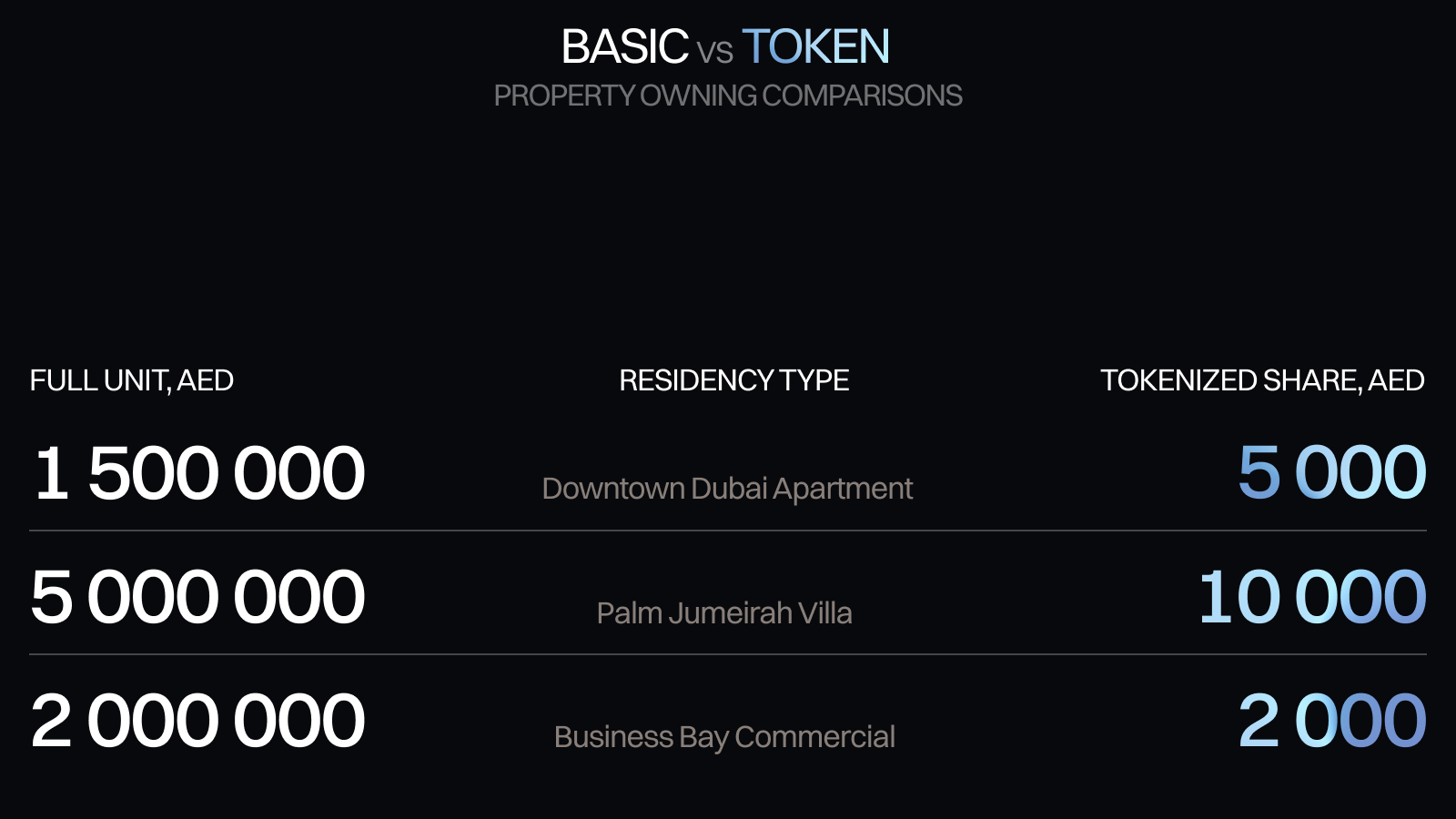

"Property tokenization fundamentally changes who can enter the Dubai's real estate market," explains Anna, a real estate agency THEBROKS CEO. "A property worth 2 million AED can be chopped into thousands of tokens, allowing investors to dip their toes in with as little as 5,000 AED."

These blockchain-based tokens stand for legal ownership of a property chunk, complete with rights to proportional rental income and capital appreciation. Each token is backed by the actual property and registered with the Dubai Land Department, ensuring legitimate title deed connections and regulatory protection.

How Tokens Make Dubai Real Estate Accessible

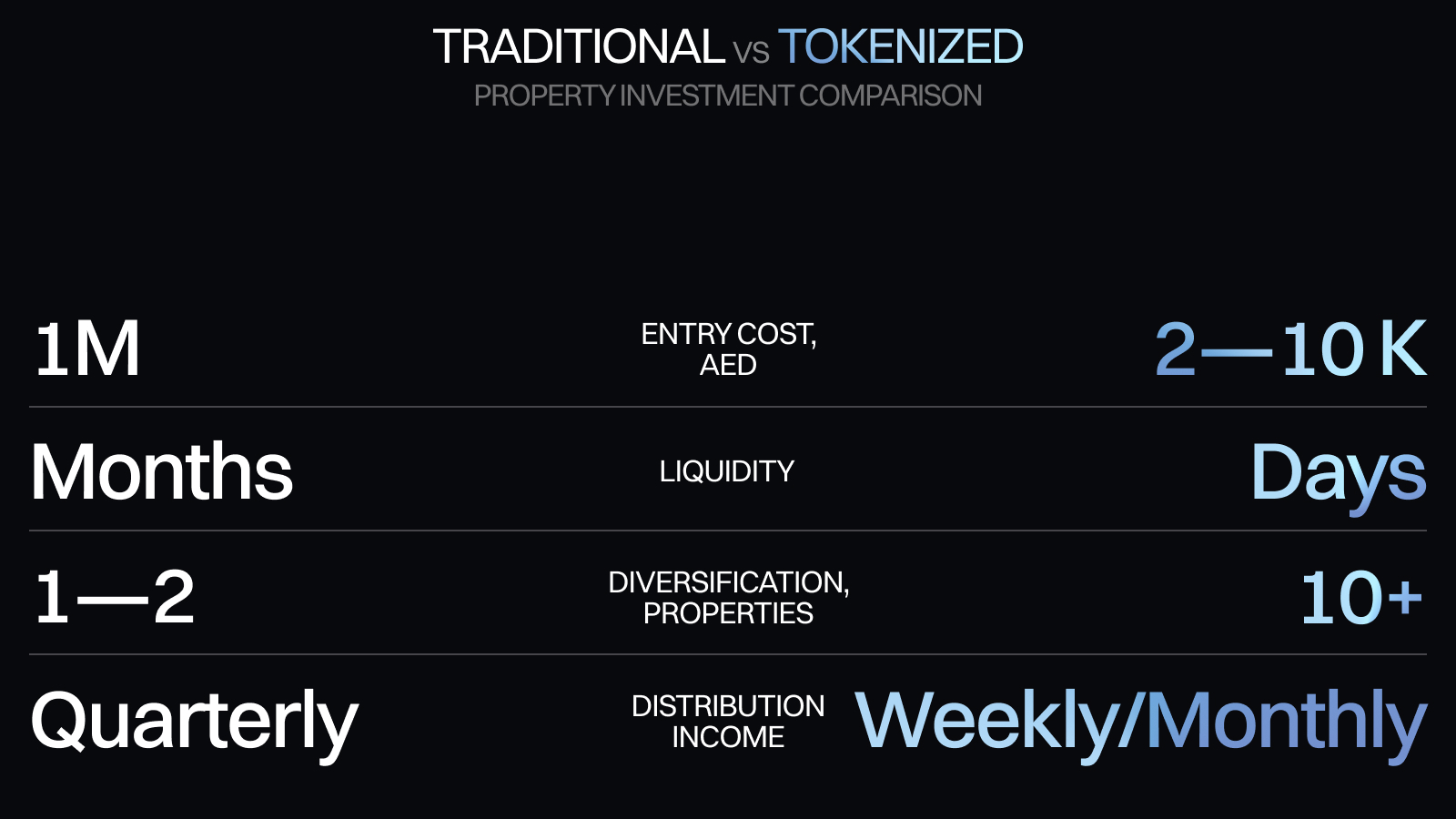

Traditional property in Dubai for investment typically demands hefty capital outlays — often between 1-5 million AED for premium locations. This towering threshold has historically, on a related note, limited market participation to experienced investors or institutional players. Tokenization dramatically knocks down this barrier.

By facilitating investments beginning at just 2,000 AED, tokenization has opened up opportunities in the Dubai real estate market to a broader audience of investors, as the Dubai financial market continues to achieve record-breaking results. An increasing number of investors from around the world are eager to participate, including both seasoned professionals and newcomers alike. This democratization allows first-time investors, young up-and-comers, and international buyers with tight budgets to play in one of the world's most vibrant real estate markets.

Furthermore, tokenization streamlines the investment journey, wiping out many traditional buying headaches and shrinking transaction times from weeks to days or even hours.

Furthermore, tokenization streamlines the investment journey, wiping out many traditional buying headaches and shrinking transaction times from weeks to days or even hours.

How to Buy Property Tokens in Dubai

If you're eager to make a purchase of the property in Dubai as a foreigner through tokenization, follow these structured steps:

Research and Select a Platform

Several regulated platforms now offer tokenized properties in Dubai. Leading options include SmartCrowd, Stake —, each operating under Financial Services regulatory frameworks. Compare their offerings, fee structures, and minimum investment requirements.

Complete KYC Verification

All platforms require Know Your Customer verification to comply with UAE regulations. Prepare your passport, proof of address, and sometimes a bank statement. The verification process typically takes 24-48 hours.

Browse Available Properties

Platforms showcase properties with detailed information about location, current value, projected returns, and token prices. Use property finder features to filter options based on your investment criteria and budget constraints.

Perform Due Diligence

Too often overlooked, you should review property documentation, including title deeds, tenant contracts (if already leased), maintenance records, and property valuation reports. Most platforms provide these documents digitally.

Purchase Tokens

Once you've selected a property, figure out how many tokens you wish to get. Payment methods typically include bank transfers, credit cards, and sometimes cryptocurrencies. The platform will record your ownership on the blockchain.

Manage Your Investment

After purchase, you'll receive access to a dashboard where you can keep tabs on property performance, rental income distributions, and options to buy or sell tokens on the secondary market.

The Legal Framework for Tokenized Real Estate in Dubai

Understanding Dubai freehold zones is, to be candid, essential when considering tokenized investments. The Dubai Land Department has established clear regulations for tokenized properties, primarily focusing on those in freehold zones where foreigners have full ownership rights.

The regulatory framework involves three key entities:

This triple-layered regulatory protection ensures buyers receive the same legal ownership rights whether purchasing entire properties or fractional tokens. All tokenized properties are registered with the DLD through smart contracts that automatically execute and record transactions.

The regulatory framework involves three key entities:

- Dubai Land Department (DLD): Verifies and records tokenized property ownership on the blockchain

- Dubai Virtual Assets Regulatory Authority (VARA): Oversees platforms trading tokenized real estate

- Financial Services Regulatory Authority (FSRA): Regulates investment aspects of tokenization platforms

This triple-layered regulatory protection ensures buyers receive the same legal ownership rights whether purchasing entire properties or fractional tokens. All tokenized properties are registered with the DLD through smart contracts that automatically execute and record transactions.

"Dubai's approach to regulating tokenized real estate is among the most advanced globally," explains Wayne, from THEBROKS. "The framework protects investors while enabling innovation, creating confidence in this new investment avenue."

Tokenized Property vs Traditional Investment

When comparing tokenized real estate with conventional buying a flat in Dubai, several advantages become apparent:

Lower Entry Cost

Liquidity

Diversification

Management Hassle

Returns Distribution

The ability to diversify across multiple properties while starting with minimal capital represents, in a way, a complete game-changer in how to buy property in Dubai. Investors can now create balanced portfolios across different neighborhoods and property types without committing to full ownership of any single asset.

Lower Entry Cost

- Traditional: Minimum 500,000-1,000,000 AED plus fees

- Tokenized: Starting from 2,000-10,000 AED

Liquidity

- Traditional: Months to sell, high transaction costs

- Tokenized: Tokens can be traded in seconds on secondary markets with minimal fees

Diversification

- Traditional: Capital is typically tied to a single property

- Tokenized: The same investment amount can be spread across multiple properties

Management Hassle

- Traditional: The owner handles maintenance, tenants, and paperwork

- Tokenized: Professional management handles all property-related matters

Returns Distribution

- Traditional: Quarterly or annual rent collection

- Tokenized: Monthly or even weekly automated distributions

The ability to diversify across multiple properties while starting with minimal capital represents, in a way, a complete game-changer in how to buy property in Dubai. Investors can now create balanced portfolios across different neighborhoods and property types without committing to full ownership of any single asset.

Top Dubai Areas for Tokenized Property Investment

{$te}

For those wondering how to buy a house in Dubai through tokenization, location remains, at first glance, a crucial factor, the same as for initial property buying in Dubai. Current tokenization platforms focus primarily on properties in high-demand areas with strong rental yields and appreciation potential.

Top areas include:

Downtown Dubai

Dubai Marina

Business Bay

Jumeirah Village Circle

Dubai Hills Estate

Top areas include:

Downtown Dubai

- Average tokenized entry: 5,000 AED

- Expected annual yield: 5.8-6.5%

- 5-year appreciation forecast: 25-30%

Dubai Marina

- Average tokenized entry: 3,000 AED

- Expected annual yield: 6.2-7.0%

- 5-year appreciation forecast: 20-25%

Business Bay

- Average tokenized entry: 4,000 AED

- Expected annual yield: 7.0-7.8%

- 5-year appreciation forecast: 28-33%

Jumeirah Village Circle

- Average tokenized entry: 2,000 AED

- Expected annual yield: 7.5-8.2%

- 5-year appreciation forecast: 15-20%

Dubai Hills Estate

- Average tokenized entry: 6,000 AED

- Expected annual yield: 5.5-6.2%

- 5-year appreciation forecast: 30-35%

"The beauty of tokenized investing is access to premium locations that would otherwise be financially out of reach," says real estate analyst Anna, CEO of THEBROKS. "An investor with 50,000 AED can now build a diversified portfolio across multiple prime Dubai locations rather than being priced out entirely."

How to Buy a House in Dubai Through Tokens

While tokenization typically begins with fractional ownership, accumulating tokens can eventually lead to full property ownership. This stepped approach provides a pathway for investors to work toward complete ownership of a Dubai property.

The process works as follows:

Some platforms even offer "token-to-mortgage" programs in partnership with UAE banks, where token ownership history serves as a financial track record for mortgage applications. This innovative approach creates a stepping stone to traditional property finder success for those with limited initial capital.

For buyers specifically interested in residential use rather than just investment, several platforms now offer "live-in rights" once a certain ownership threshold (typically 25-30%) is reached, creating a unique rent-to-own model through tokenization.

The process works as follows:

- Begin with token purchases based on your budget.

- Gradually acquire additional tokens in the same property as your finances allow

- Once you own a significant percentage (typically >50%), some platforms offer preferential rights to purchase remaining tokens.

- At 100% ownership, you can convert tokens to a traditional title deed.

Some platforms even offer "token-to-mortgage" programs in partnership with UAE banks, where token ownership history serves as a financial track record for mortgage applications. This innovative approach creates a stepping stone to traditional property finder success for those with limited initial capital.

For buyers specifically interested in residential use rather than just investment, several platforms now offer "live-in rights" once a certain ownership threshold (typically 25-30%) is reached, creating a unique rent-to-own model through tokenization.

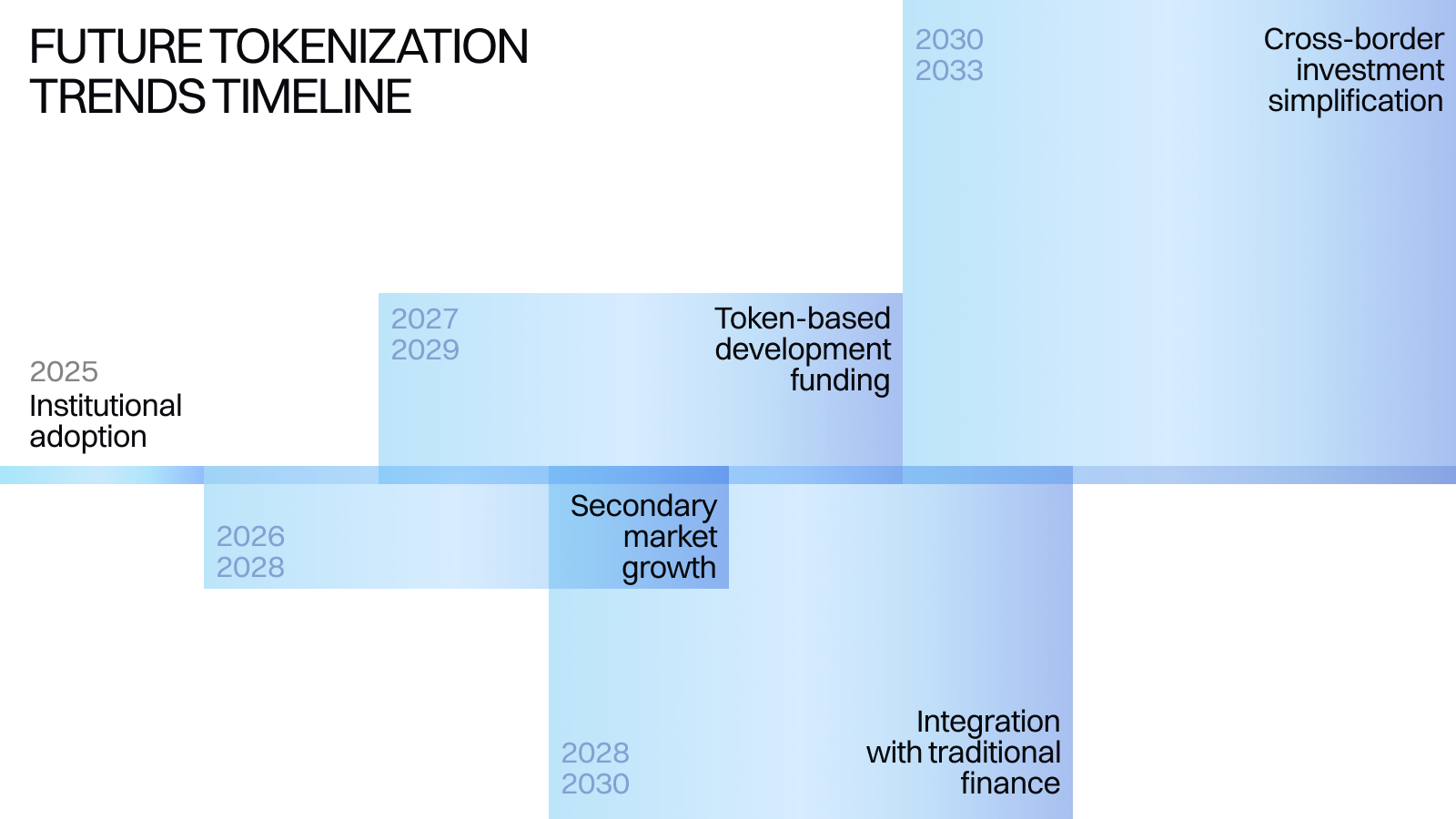

Future of Real Estate Investment in Dubai: Tokenization Trends

The Dubai real estate tokenization market is projected to reach 60 billion AED by 2033, representing approximately 20% of the emirate's property transactions. This explosive growth is driven by several emerging trends:

Institutional Adoption

Major developers like Emaar Properties and DAMAC are launching their tokenization platforms, bringing blue-chip properties into the tokenized ecosystem.

Secondary Market Growth

Secondary Market Growth

Trading volumes on tokenized real estate secondary markets are increasing by 30% quarter-over-quarter, improving liquidity for investors.

Token-Based Development Funding

Token-Based Development Funding

New developments are being partially funded through pre-construction tokenization, allowing investors to participate in earlier stages of the property lifecycle.

Integration with Traditional Finance

Banks is beginning to accept tokenized real estate as collateral for loans, bridging the gap between traditional finance and digital assets.

Cross-Border Investment Simplification

Tokenization is removing international investment barriers, with platforms reporting over 60% of investors coming from outside the UAE.

Integration with Traditional Finance

Banks is beginning to accept tokenized real estate as collateral for loans, bridging the gap between traditional finance and digital assets.

Cross-Border Investment Simplification

Tokenization is removing international investment barriers, with platforms reporting over 60% of investors coming from outside the UAE.

Frequently Asked Questions: Dubai Tokens

1. Can foreigners buy tokenized property in Dubai?

Yes, foreigners can purchase tokenized property in Dubai with the same rights as traditional property investment in freehold zones. The tokenization platforms handle all regulatory compliance to ensure foreign investors receive legally protected ownership rights.

2. What are the minimum investment amounts for tokenized real estate?

Minimum investments start from as low as 2,000 AED on some platforms, though the average minimum across major platforms is approximately 5,000 AED. This varies based on the specific property, location, and platform policies.

3. How is the ownership legally protected?

Tokenized ownership is legally protected through smart contracts registered with the Dubai Land Department. These contracts link digital tokens to the physical property's title deed, ensuring all ownership rights are recognized under UAE law.

4. Can I sell my property tokens easily?

Yes, most platforms provide secondary markets where investors can list their tokens for sale. Liquidity varies by platform and property, but transaction times typically range from immediate to 7 days, significantly faster than traditional real estate sales.

5. Are there additional fees for tokenized property investments?

Yes, platforms typically charge fees, including:

- Entry fee: 1-3% of investment amount

- Annual management fee: 0.5-2%

- Performance fee: 5-10% of profits (on some platforms)

- Exit fee: 0-1% (varies by platform and holding period)

Always review the fee structure before investing, as these costs impact your overall returns.

Property tokenization has, actually, transformed how to buy a house in Dubai, making the market accessible to a vastly broader audience and fully aligning with Dubai Economic Agenda D33. By removing traditional barriers to entry, this innovative approach allows investors with modest budgets to build diversified real estate portfolios in one of the world's most prestigious property markets. As the technology and regulatory frameworks continue to mature, tokenization promises to remain at the forefront of Dubai's ever-evolving real estate landscape, creating unprecedented opportunities for investors at all levels.

For those looking to enter Dubai's property market with limited capital, tokenization represents not just an alternative, but potentially the future of real estate investment itself.